IRA investments can be a fantastic way to secure your financial future, but understanding the different options available is important. A Gold IRA allows you to diversify your retirement portfolio by investing in precious metals, which can offer protection against inflation and market volatility. In this post, you will discover what makes a Gold IRA ideal for your retirement strategy, the potential benefits and risks involved, and how to choose the best one for your needs. Let’s look into the world of Gold IRAs!

Understanding Gold IRAs

Your journey into investing in gold through a self-directed Individual Retirement Account (IRA) can help diversify your portfolio and protect your savings. Gold IRAs are a unique option that allows you to hold physical gold and other precious metals, which can be especially appealing in times of economic uncertainty.

What Is a Gold IRA?

IRAs, or Individual Retirement Accounts, are investment vehicles designed to help you save for retirement while providing tax advantages. A Gold IRA is a specialized type of IRA that allows you to invest in physical gold, as well as other precious metals like silver and platinum, offering a tangible asset option in your retirement savings plan.

Benefits of Investing in Gold

An investment in gold can provide you with a hedge against inflation and stock market volatility. By adding gold to your portfolio, you may experience increased stability and a potential for long-term growth, making it a wise choice for retirement security.

Plus, investing in gold offers several benefits: it is a safe-haven asset that tends to maintain its value during economic downturns, thereby reducing risk in your portfolio. Furthermore, gold is a global asset, meaning its value is not tied to a single currency or economy, which can enhance your investment diversification. Keep in mind that while gold offers many advantages, it’s important to weigh these against potential downsides and stay informed about market trends to ensure a smart investment choice.

How to Choose the Best Gold IRA

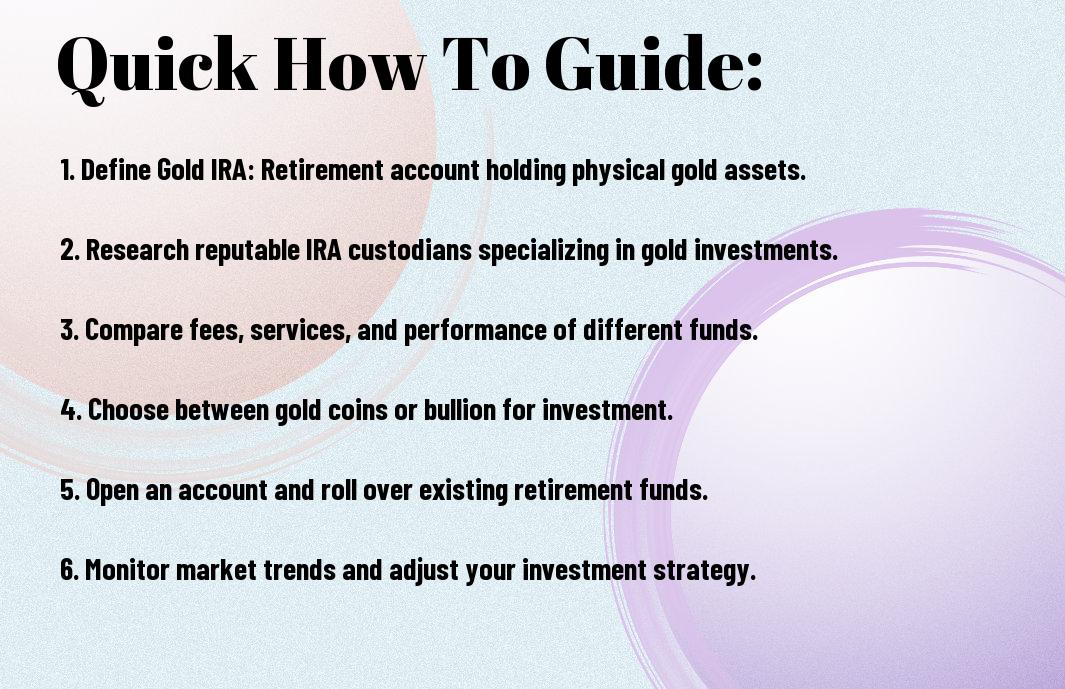

Clearly, selecting the right Gold IRA involves understanding various factors that can impact your investment. It’s crucial to conduct thorough research to ensure you’re making the most informed decision tailored to your financial goals.

Key Factors to Consider

Consider the following aspects when evaluating a Gold IRA:

- Fees: Understand all associated costs.

- Storage Options: Review where your gold will be stored.

- Reputation: Assess the company’s standing in the industry.

- Customer Service: Evaluate the level of support offered.

Thou shall ensure these elements align with your investment objectives.

Tips for Selecting a Trusted Provider

You should seek a provider with a solid track record and transparent practices. Consider the following when choosing:

- Industry Experience: Look for established companies.

- Customer Reviews: Check for positive feedback from clients.

- Certifications: Ensure they comply with regulatory standards.

- Investment Options: Confirm a variety of gold products.

The right provider can make your Gold IRA experience seamless and rewarding.

A trusted provider often offers valuable insights and ensures your investment is secure. Consider these additional points:

- Transparency: Ensure clear communication regarding fees and processes.

- Insurance Coverage: Verify that your investment is adequately protected.

- Educational Resources: Look for companies that offer guides and support for investors.

The choice of provider can significantly impact your satisfaction and financial success in the long run.

Steps to Set Up Your Gold IRA

Once again, setting up your Gold IRA involves a few simple steps to ensure you’re on the right path to safeguarding your retirement savings. You’ll need to select a reliable custodian, choose the appropriate type of gold, and open an account. Following this guide will help you secure the necessary resources for a successful investment in precious metals.

Opening Your Account

Your first step is to open your Gold IRA account with a reputable custodian. The custodian will help you navigate all the paperwork and regulations. They play a vital role in ensuring your investment is handled safely, so choose one that has excellent reviews and a solid track record to give you peace of mind.

Funding Your Gold IRA

Any time you want to fund your Gold IRA, you can do so through a variety of methods, such as transferring funds from an existing retirement account or contributing cash directly. Be sure to consult with your custodian about any limits and guidelines to keep everything compliant.

Steps to fund your Gold IRA typically involve making a direct transfer from an existing IRA, rolling over a 401(k), or making a new contribution. Start by contacting your current plan administrator to initiate the transfer process. Ensure you follow all the necessary steps to avoid any tax penalties, which can be detrimental to your investment strategy. Additionally, it’s beneficial to understand that some funding methods may involve waiting periods, so plan your funding accordingly to enhance your investment portfolio without delays.

How to Manage Your Gold IRA

Not only does managing your Gold IRA require diligence, but it also involves staying informed about market trends and the performance of your investments. You’ll need to regularly review your holdings, fees, and the overall strategy you have in place to ensure it aligns with your financial goals. Additionally, keeping communication lines open with your custodian can provide insights and help you make informed decisions.

Monitoring Your Investment

Monitoring your Gold IRA is necessary for ensuring it meets your investment objectives. Regularly check the performance of your gold assets, and stay updated on market trends that could impact their value. This proactive approach allows you to adapt to any fluctuations and maintain a healthy balance in your portfolio.

Making Adjustments as Needed

To maintain a successful Gold IRA, you might find that making adjustments is necessary based on market conditions or your personal circumstances.

It is vital to assess your investment strategy periodically, especially when there are significant shifts in the market or changes in your financial situation. If you notice underperforming assets or feel your risk tolerance has changed, you may need to reallocate your holdings or consider diversifying your investments. Staying adaptable and willing to adjust your strategy can help you optimize your Gold IRA for long-term success.

Common Mistakes to Avoid

All investors can benefit from avoiding common pitfalls in their Gold IRA journey. Understanding these missteps can significantly enhance your investment experience and potential returns. Make sure to educate yourself on what to watch for to ensure a smooth and profitable venture into gold investments.

Overlooking Fees

Clearly, one of the biggest mistakes you can make is overlooking fees associated with your Gold IRA. These fees can accumulate quickly, eating into your investment returns. Always read the fine print and ask your custodian for a breakdown of all costs involved, including setup, storage, and transaction fees.

Ignoring IRS Regulations

Avoid skipping over IRS regulations that govern Gold IRAs. Adhering to these rules is vital to maintain the tax-advantaged status of your account and avoid unnecessary penalties.

It is imperative to familiarize yourself with the IRS regulations surrounding Gold IRAs to prevent costly mistakes. For example, you must ensure that your investments are in IRS-approved precious metals to avoid disqualification and hefty penalties. Furthermore, understanding contribution limits and distribution rules is vital for maintaining compliance. By taking the time to educate yourself on these regulations, you can secure your investment’s future and enjoy the benefits of a Gold IRA without the stress of unexpected complications.

Frequently Asked Questions

To help you better understand gold IRAs, we’ve compiled a few frequently asked questions. If you’re curious about how to navigate this investment opportunity, you’re in the right place! This section aims to clarify common uncertainties and enhance your confidence in making informed decisions about your financial future.

What Types of Gold Can You Invest In?

To ensure your investment aligns with IRS regulations, you can consider various types of gold for your IRA. The following options are generally accepted:

| Type of Gold | Description |

| Gold Coins | Popular choices include American Gold Eagles and Canadian Gold Maple Leafs. |

| Gold Bars | Available in various weights, often purchased from reputable dealers. |

| Gold Bullion | Structurally significant due to their high purity. |

| Gold ETFs | Exchange-traded funds can also be an option if you prefer indirect investment. |

After exploring these options, you can confidently decide which type of gold fits best into your investment strategy.

How Does a Gold IRA Compare to Other Retirement Accounts?

Asked about the differences between a gold IRA and traditional accounts, you’ll find that they serve unique purposes in retirement planning. Here’s a breakdown:

| Gold IRA | Invests primarily in physical gold and precious metals. |

| Traditional IRA | Invests in stocks, bonds, and mutual funds. |

| Risk Diversification | Gold provides a hedge against inflation and market volatility. |

| Liquidity | Gold can be less liquid than stocks, depending on market demand. |

| Tax Benefits | Both account types offer tax advantages, though rules differ. |

With gold IRAs, you gain exposure to a tangible asset that can serve as a protective measure during economic downturns. However, it’s imperative to consider that while they can provide stability, they may also involve higher fees and less liquidity compared to standard investment accounts.

Final Words

Summing up, understanding a gold IRA is all about making informed choices for your financial future. By recognizing the benefits and risks associated with this investment, you can align it with your personal goals and values. Whether you’re looking to diversify your portfolio or safeguard your retirement savings, a gold IRA could be a valuable option for you. Take your time, do your research, and you’ll be well on your way to making confident investment decisions that suit your needs.

FTC Disclaimer and Disclosure

This article is intended for informational purposes only and should not be considered investment advice. The content is based on publicly available information and is not a solicitation to buy or sell any financial products. Any investment decisions should be made after consulting with a financial advisor.