Gold can be a fantastic way to diversify your investment portfolio, especially when it comes to securing your financial future. In this post, we’ll explore the best Gold IRA options for building wealth, helping you make informed decisions. We’ll examine into key features, potential risks, and benefits associated with gold investments, ensuring you have the right knowledge to boost your savings. Let’s get started on your path to financial growth!

How to Choose the Best Gold IRA

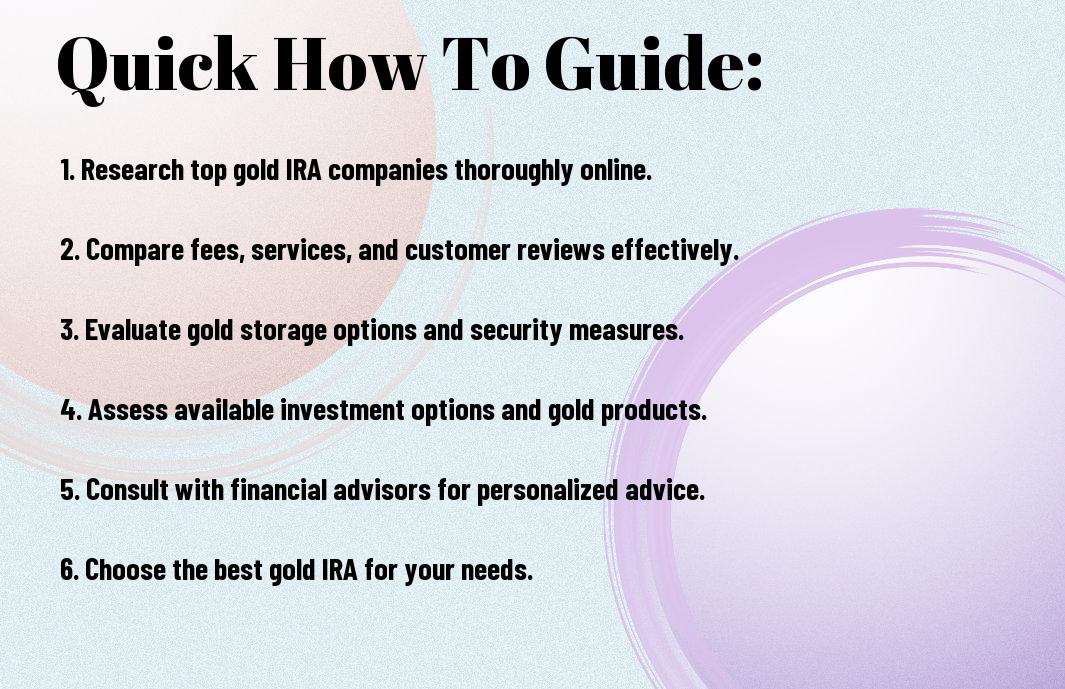

Before you explore investing, it’s important to lay the groundwork for selecting the best Gold IRA for your needs. Research various companies and their offerings to find what aligns with your financial goals. Also, look for transparency regarding fees, customer support, and the range of precious metals they allow. Comparing multiple options will help you make an informed decision.

Tips for Identifying Reputable Providers

For finding trustworthy Gold IRA providers, consider these tips:

- Check for strong customer reviews

- Confirm their industry experience

- Look for appropriate regulatory compliance

- Ask about fees and commissions

The reliability of providers will enhance your investment experience.

Factors to Consider When Investing

Identifying the right elements for your Gold IRA investment can elevate your results. Key factors include:

- Understanding market trends

- Considering storage options

- Reviewing liquidity needs

- Evaluating tax implications

Knowing these aspects will help tailor your investment strategy for success.

This understanding is vital to maximizing your Gold IRA. By staying informed on market fluctuations, you can anticipate changes that impact your assets. Always consider how storage methods affect safety and access to your gold, and be aware of your liquidity needs to ensure you can cash in if necessary. Additionally, consult a financial advisor about tax implications that can arise, as they can significantly influence your returns. Knowing these factors will guide you towards effective decision-making for your wealth-building journey.

How to Set Up Your Gold IRA

You can easily set up your Gold IRA by following a few simple steps. Begin by researching reputable custodians who specialize in precious metals. Next, open your IRA account, fund it with cash or a transfer from another retirement account, and purchase your desired gold assets. Lastly, make sure to store your gold in an IRS-approved depository to comply with regulations and protect your investment.

Step-by-Step Guide for New Investors

For those just starting, the process can seem overwhelming. Here’s a quick guide to help:

| Steps | Details |

|---|---|

| Choose a Custodian | Research and select a reputable custodian specializing in Gold IRAs. |

| Open Your Account | Complete the paperwork to set up your Gold IRA. |

| Fund Your Account | Transfer funds from another retirement account or contribute cash. |

| Select Your Gold | Choose the type of gold you wish to invest in. |

| Store Your Gold | Utilize an IRS-approved depository for secure storage. |

Common Mistakes to Avoid

To ensure a smooth process, avoid these common pitfalls.

A common mistake is neglecting to research your options thoroughly and simply choosing the first custodian that appears. This can lead to unwanted fees or poor investment choices. Additionally, don’t overlook the importance of maintaining adequate documentation of all transactions involved in your Gold IRA. This will help to prevent complications with the IRS and foster a positive experience with your investment.

Tips for Maximizing Your Investment

Once again, optimizing your Gold IRA requires careful planning and strategy. Here are some tips to help you:

- Stay informed about market trends.

- Consider working with a financial advisor.

- Regularly review your portfolio.

- Invest in reputable precious metals.

- Diversify your holdings to spread risk.

Assume that implementing these tips can significantly enhance your investment growth.

Diversification Strategies

Your goal should be to create a balanced portfolio that includes a mix of assets. By diversifying within your Gold IRA, you can mitigate risks and capitalize on various market conditions. Consider including other precious metals like silver or platinum, alongside different asset classes, to achieve a well-rounded investment.

Long-term Wealth Building Strategies

Diversification is necessary for creating a sustainable wealth-building approach. You should focus on maintaining a long-term perspective by being patient and allowing your Gold IRA to grow over time. Regular contributions and periodic portfolio reassessments will boost your returns.

Building a solid strategy also involves setting clear financial goals. You should think about how much you want to save for retirement and adjust your contributions accordingly. Additionally, reinvesting your gains can help compound your wealth. However, be aware that investing in gold, like any investment, comes with risks such as market fluctuations. Therefore, ensure you stay diligent and informed to make sound decisions as you work towards your long-term financial objectives.

How to Monitor Your Gold IRA

To effectively manage your Gold IRA, you need to stay informed about its performance. Regularly reviewing market trends and your account statements allows you to make informed decisions regarding your investments. Keep an eye on gold prices, market conditions, and other economic factors that could impact your IRA. Establish a consistent schedule to assess your portfolio and ensure it aligns with your wealth-building goals.

Tools and Resources for Tracking Performance

Tracking your Gold IRA‘s performance is important for your financial success. Utilize online platforms, financial apps, and resources that provide real-time updates on gold prices and market trends. Many custodians also offer user-friendly dashboards to monitor your IRA, giving you insights into your investments and their growth. Leverage these tools to gain a better understanding of your portfolio’s performance, enhancing your decision-making process.

Making Adjustments to Your Portfolio

You have the ability to refine your Gold IRA by making adjustments as necessary. Regularly reassess your asset allocation, taking into consideration changes in your financial goals or market trends. If you notice shifts in gold prices or economic indicators, be proactive in reallocating your investments to maximize growth potential. Balancing your portfolio can help ensure it remains aligned with your long-term objectives.

With a thoughtful approach to portfolio adjustments, you can enhance your Gold IRA strategy. Assess your risks and opportunities regularly, and don’t hesitate to make changes when needed. Stay informed about both your investments and the market. If your financial goals shift or you identify underperforming assets, consider reallocating those funds to areas that may yield better returns. Embracing flexibility in your investment strategy allows you to cultivate a more resilient and profitable Gold IRA.

Frequently Asked Questions

For many investors, exploring Gold IRAs raises significant questions. You may wonder about the benefits, risks, and procedures involved in this form of investment. In this section, we’ll tackle the most common inquiries to give you clarity and confidence as you consider adding precious metals to your retirement fund.

Common Concerns About Gold IRAs

IRAs can seem complex, especially when it comes to precious metals. You might be concerned about the storage, insurance, and overall security of your gold investments. It’s vital to know that reputable gold IRA providers offer solutions to safely manage and protect your investment, minimizing risks and ensuring your assets stay secure.

Expert Opinions on Gold Investments

Clearly, many financial experts advocate for gold as a strong investment. While you want to diversify your portfolio, gold can serve as a hedge against inflation and economic uncertainty. However, market volatility means you should approach gold investments with caution. Even experts suggest consulting with a financial advisor to evaluate how much gold aligns with your overall investment strategy.

Opinions on gold investments vary among experts; some emphasize its stability during economic downturns, while others caution about the potential for price fluctuations. Understanding the balance between risk and reward is vital for you as an investor. Make sure to assess your overall financial strategy and consider how gold can enhance your wealth-building objectives while ensuring you are prepared for market changes.

Resources for Further Learning

Many individuals seek to deepen their understanding of Gold IRAs and wealth building. Fortunately, there are numerous resources available, including books, articles, and online tools, that can help you navigate the world of gold investments. These resources will empower you to make informed decisions as you work towards building your financial future.

Recommended Books and Articles

For those with a thirst for knowledge, exploring well-researched books and insightful articles can provide a solid foundation in Gold IRAs. Titles like “The Ultimate Guide to Gold IRAs” and various finance blogs offer strategies, tips, and in-depth analyses of the gold market, enabling you to understand how to effectively use these assets for wealth building.

Online Tools for Gold IRA Investors

Some great online tools are available to assist you in managing your Gold IRA investments effectively. From calculators that estimate potential returns to platforms that help compare different gold custodians, these tools are designed to streamline your investment process and enhance your understanding of the gold market.

Online, you can access various platforms like Gold IRA calculators, which help you estimate potential returns and account balances over time. Additionally, sites offering investment comparison tools allow you to evaluate different Gold IRA custodians and their fees, helping you make informed choices. Certain forums and community resources also provide valuable peer feedback, allowing you to learn from others’ experiences in the gold investment space. This wealth of information is at your fingertips, making it easier to navigate your investment journey successfully.

Final Words

Now that you’ve explored the best Gold IRA options for wealth building, you can confidently make a choice that suits your financial goals. Investing in gold can be a smart move, providing you with a solid foundation for your retirement portfolio. As you begin on this journey, keep in mind the benefits of diversifying your investments and the importance of finding a trustworthy provider. With the right Gold IRA, you’re one step closer to securing your financial future. Happy investing!

FTC Disclaimer and Disclosure

This article is intended for informational purposes only and should not be considered investment advice. The content is based on publicly available information and is not a solicitation to buy or sell any financial products. Any investment decisions should be made after consulting with a financial advisor.