This blog post unveils the seven hidden gems of a successful Gold IRA that can significantly impact your investment strategy. You’ll discover crucial tips that seasoned experts might not share, helping you to navigate the world of gold investments with confidence. Whether you’re just starting or looking to optimize your existing account, these insights will empower you to make informed decisions and maximize your returns. Let’s examine these secrets and enhance your financial future with gold!

How to Choose the Right Gold IRA

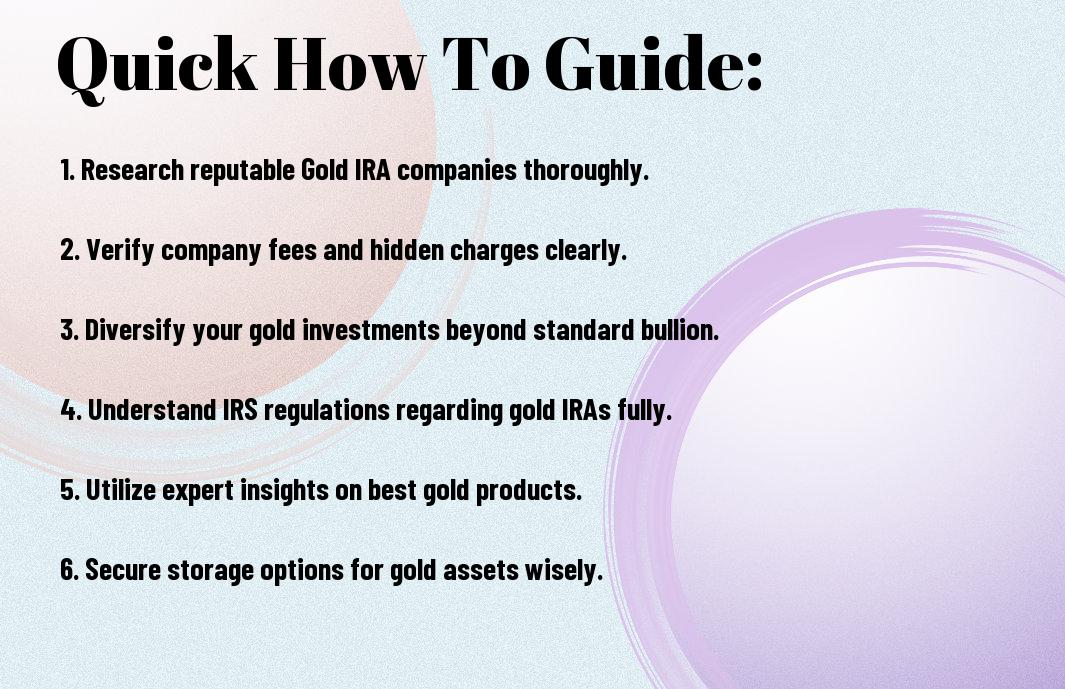

A good Gold IRA can secure your financial future, but choosing the right one requires thoughtful consideration. Start by researching various options, checking for fees, offerings, and the reputation of custodians. Focus on finding a reputable company that can help you navigate this process effectively and offer valuable insights into market trends. This diligence ensures that your hard-earned money is wisely invested.

Tips for Selecting a Trusted Custodian

Trusted custodians are important for your Gold IRA, and selecting the right one can make all the difference. Here are some tips to help you:

- Verify the custodian’s experience in the industry.

- Look for transparency in fees and services offered.

- Check for regulatory compliance and consumer reviews.

- Ensure they provide comprehensive customer support.

Knowing how to evaluate custodians can simplify your investment journey.

Factors to Consider When Choosing Gold Investments

To make informed decisions, you should consider several factors before investing in gold. Take into account the type of gold investment, such as coins or bullion, and assess their market value and liquidity. Additionally, pay attention to the purity of gold, as it can impact resale value. Understanding these elements can significantly influence your investment returns.

Plus, you should evaluate the historical performance of gold, potential tax implications, and how each investment fits into your overall diversification strategy. Also, consider any storage and insurance costs involved with physical gold. Any decision you make will be more robust if informed by a thorough understanding of these factors.

How to Fund Your Gold IRA

You can initiate on your journey to a successful Gold IRA by understanding the various funding options available. Typically, you can fund your account through methods like transferring funds from an existing retirement account, making a cash contribution, or rolling over funds from a qualifying plan. Each method has its unique benefits, so taking the time to explore them will help you establish a robust investment plan for the future.

Tips for Making the Most of Your Contributions

Your financial strategy should include effective ways to maximize your Gold IRA contributions. Consider these tips:

- Start early to benefit from compound growth.

- Make consistent contributions throughout the year.

- Stay updated on contribution limits.

Thou might find it easier to grow your savings by following these strategies!

Factors Influencing Your Investment Amount

Little factors can greatly affect how much you choose to invest in your Gold IRA. Important details to consider include:

- Your financial goals and retirement plans.

- The current market conditions for gold.

- Your risk appetite and investment strategy.

Perceiving these elements clearly will help you make informed decisions about your contributions.

A deeper understanding of various elements can guide your investment amount. For instance, if your goal is to retire comfortably, you may want to allocate more funds to your Gold IRA. In addition, if the market conditions indicate a favorable time to invest in gold, you might choose to invest more aggressively. Evaluating your risk appetite will also shape the amount you contribute. Aligning your investments with your long-term goals is beneficial for a secure financial future, driving better retirement outcomes. Perceiving these insights can guide your strategy toward lasting success.

Diverse Your Gold IRA Portfolio

Keep in mind that diversification is key when it comes to your Gold IRA portfolio. A well-balanced portfolio can help you manage risk and maximize potential returns. You can achieve this by including different types of gold assets like physical gold, gold ETFs, and gold mining stocks. This not only stabilizes your investments but also increases your chances of capitalizing on market fluctuations.

Tips for Including Different Types of Gold Assets

- Physical Gold – Purchase coins or bars to hold directly.

- Gold ETFs – Invest in exchange-traded funds for liquidity.

- Gold Mining Stocks – Consider investing in companies that mine gold.

- Gold Mutual Funds – Look for funds that focus on gold-related ventures.

- Rare Coins – Collecting can add additional value to your portfolio.

Recognizing the different types of gold assets you can include will help you create a more resilient portfolio.

Factors to Assess for Portfolio Balance

Any successful portfolio balance requires careful assessment of several important factors. You should evaluate your risk tolerance, investment goals, market trends, asset allocation, and time horizon when constructing your Gold IRA portfolio. Each factor plays a distinct role in guiding your investment decisions and helps maintain balance.

It’s vital to analyze these elements to create a Gold IRA portfolio that matches your needs. Evaluating risk tolerance helps you determine how much volatility you can withstand, while clarifying your investment goals allows you to set specific targets. Keep an eye on market trends to understand the value of gold. A smart asset allocation strategy will ensure you’re not overly exposed to any single asset, and having a defined time horizon helps you stay focused on your long-term objectives. Any decision rooted in these factors increases the chance of portfolio success.

How to Minimize Fees and Expenses

Not all investment options have to drain your savings. Understanding how to minimize fees and expenses in your Gold IRA allows you to keep more of your hard-earned money working for you. By being aware of different fee structures and asking detailed questions, you can significantly reduce your overall investment costs.

Tips for Finding Low-Cost Options

Tips for finding low-cost options are crucial for maximizing your Gold IRA returns. Consider these strategies:

- Research custodians that offer competitive fees.

- Compare investment options to find low-cost providers.

- Look for promotions or waivers on initial fees.

Knowing the market well can help you secure a better deal.

Factors That Impact IRA Fees

You may be surprised by the various factors that impact IRA fees. Key elements to consider are:

- The choice of custodian for your Gold IRA.

- Types of investments you choose to hold.

- The size of your investment can affect fee structures.

This can make a significant difference in your investment’s overall performance.

Fees associated with managing your Gold IRA can greatly influence your returns. Common charges include annual maintenance fees, transaction fees, and storage fees. Being aware of these elements enables you to proactively seek alternatives or negotiate better terms. Additionally, the more money you invest, the lower your costs can become due to tiered pricing. Understanding these aspects will help you manage your IRA more effectively.

How to Keep Your Gold IRA Secure

After you invest in a Gold IRA, the next vital step is ensuring its security. You want to protect your investment from theft, fraud, and market volatility. This can be achieved by diversifying your assets, choosing a reputable custodian, and utilizing secure storage options. Always stay informed and proactive about the security measures that can safeguard your financial future.

Tips for Safeguarding Your Assets

There’s a variety of strategies to ensure your investments remain secure. Here are some tips to consider:

- Utilize a reputable custodian for your Gold IRA.

- Invest in a diversified portfolio to mitigate risks.

- Consider secure storage solutions, like a bank safe deposit box.

- Regularly monitor account activity for unusual transactions.

Perceiving these strategies will help you maintain the integrity of your assets.

Factors Affecting Security Measures

Little do many investors know that various factors can impact your security measures. Key considerations include the choice of your custodian, storage location, and even market trends. Each of these elements plays a vital role in maintaining the safety of your investment while ensuring steady growth. Understanding these factors allows you to take informed steps to protect your investments.

- Evaluate the reputation of your custodian.

- Choose a storage option that offers maximum security.

- Stay updated on market trends and adjust strategies accordingly.

- Implement robust insurance policies to cover unforeseen events.

Perceiving how these elements intertwine will enhance your financial security.

Gold has always been viewed as a strong asset, but its security measures are paramount to safeguarding your investment. Take the time to assess the custodians you work with and ensure they offer secure storage. Factors such as insurance coverage and market conditions should also be weighed carefully. Despite any risks involved, you can take proactive steps to secure your Gold IRA. Perceiving the landscape of security can empower you to adjust your strategies and reinforce your investment approach.

To wrap up

With this in mind, discovering the 7 secrets of the best Gold IRA can empower you to make informed decisions about your financial future. By understanding the nuances that experts often overlook, you can navigate your investments with greater confidence and security. Embrace these insights and take control of your retirement strategy, ensuring that your golden years are truly enriched by your choices today.