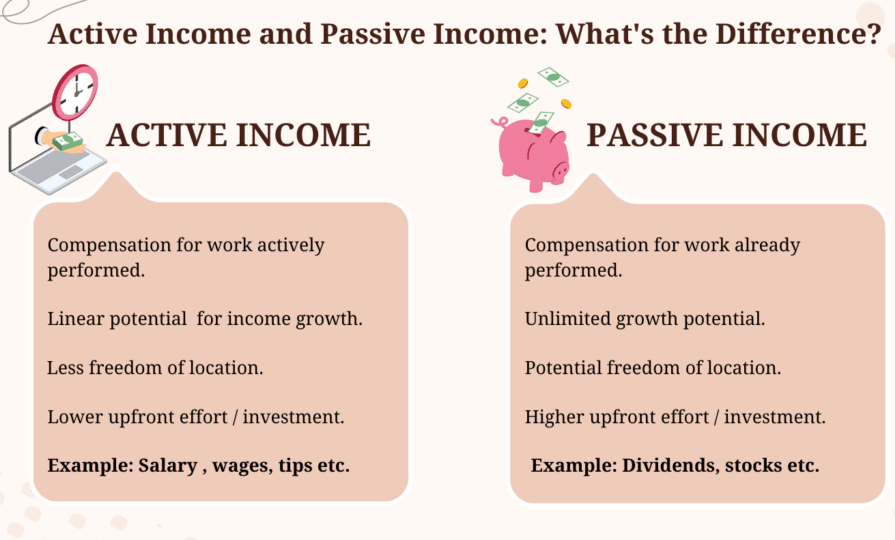

Understanding the distinctions between passive and active income is crucial for anyone aiming to achieve financial stability and independence. Each income type has its unique characteristics, benefits, and challenges. This article delves into the pros and cons of both passive and active income, providing insights to help you make informed decisions about your financial strategies.

What is Active Income?

Active income refers to earnings obtained through direct involvement or labor. This includes salaries, wages, commissions, and any other compensation received for performing a service or engaging in business activities. In essence, it’s the money you earn by trading your time and effort for compensation.

Pros of Active Income:

- Predictable Earnings: Active income provides a steady and reliable source of funds, making budgeting and financial planning more straightforward.

- Immediate Compensation: You receive payment shortly after completing your work, ensuring a consistent cash flow.

- Skill Development: Engaging in active work allows for the continuous development of skills and expertise in your field.

Cons of Active Income:

- Time-Dependent: Earnings are directly tied to the amount of time you work, limiting income potential based on available hours.

- Limited Scalability: There’s a cap on how much you can earn, as it depends on your capacity to work more hours or take on additional responsibilities.

- Job Insecurity: Economic downturns or company-specific issues can lead to job loss or reduced income.

What is Passive Income?

Passive income is generated with minimal active involvement once the initial work or investment is completed. Examples include rental income, dividends from investments, royalties from creative works, and earnings from businesses where you’re not actively involved.

Pros of Passive Income:

- Financial Freedom: Passive income can provide financial stability, allowing you to pursue other interests without the constant need for active work.

- Scalability: Many passive income streams have the potential to grow without a proportional increase in effort.

- Diversification: Having multiple passive income sources can protect against the loss of any single income stream.

Cons of Passive Income:

- Initial Effort or Capital Required: Establishing passive income streams often requires a significant upfront investment of time, money, or both.

- Risk Factors: Investments can depreciate, rental properties may remain vacant, and other passive ventures carry inherent risks.

- Maintenance: While less demanding than active income, passive income sources may still require occasional attention and management.

Comparing Passive and Active Income

| Aspect | Active Income | Passive Income |

|---|---|---|

| Time Investment | Continuous; directly tied to working hours | Significant upfront; minimal ongoing involvement |

| Income Stability | Generally stable and predictable | Can be variable; depends on the income source |

| Scalability | Limited by available time and energy | Potentially scalable without equivalent increase in effort |

| Risk Level | Lower risk; often protected by employment laws | Higher risk; subject to market fluctuations and other external factors |

| Control | More control over tasks and outcomes | Less control; influenced by external factors |

Integrating Both Income Types

Combining active and passive income streams can offer a balanced approach to financial growth. Active income provides immediate funds for daily expenses, while passive income builds long-term wealth and financial security. This strategy allows for greater flexibility and resilience in the face of economic changes.

Affiliate Products to Enhance Your Passive Income Journey

To effectively build passive income, consider leveraging tools and platforms that facilitate the creation and management of passive income streams. Here are some recommended affiliate products:

- Teachable: An online platform that allows you to create and sell courses, turning your expertise into a source of passive income.

“Transform your knowledge into a profitable online course with Teachable. Get started today!“ - Shopify: A comprehensive e-commerce platform that enables you to set up an online store and sell products with ease.

“Launch your online business effortlessly with Shopify. Start your free trial now!“ - Kinsta: A managed WordPress hosting provider that ensures your website runs smoothly, crucial for maintaining passive income streams from blogs or online stores.

“Ensure your website’s performance and security with Kinsta’s managed hosting. Learn more here!“ - ActiveCampaign: An email marketing and automation tool that helps you engage with your audience, essential for nurturing leads and driving sales passively.

“Automate your marketing efforts and boost conversions with ActiveCampaign. Try it free!“ - SEMrush: A comprehensive SEO tool that aids in improving your website’s visibility, attracting organic traffic, and increasing potential passive income.

“Enhance your online presence and drive more traffic with SEMrush. Get your free trial!“

By incorporating these tools into your strategy, you can effectively establish and grow your passive income streams.

Conclusion

Both active and passive income have their advantages and challenges. Active income offers immediate and reliable earnings but is limited by time and effort. Passive income provides the potential for ongoing earnings with less continuous effort but often requires initial investments and carries certain risks. By understanding and strategically combining both types of income, you can work towards a more secure and prosperous financial future.