Over time, investing in gold can provide you with a secure and stable asset for your retirement portfolio. A Gold IRA allows you to benefit from the value of precious metals while diversifying your investments. In this guide, you’ll discover how to choose the best options available, ensuring your future wealth and security are well-protected. Whether you’re new to gold investing or looking to expand your existing portfolio, this post will equip you with the knowledge you need to make informed decisions that align with your financial goals.

How to Choose the Best Gold IRA

Before stepping into the world of Gold IRAs, it’s vital to research and evaluate your options wisely. The best Gold IRA should offer a blend of quality, reliability, and superior customer service. Look for companies that provide transparent pricing, educational resources, and a range of investment options to align with your goals.

Tips for Identifying Reliable Gold IRA Companies

On your journey to finding a trustworthy Gold IRA company, consider the following tips:

- Check for regulatory compliance.

- Read customer reviews.

- Examine their fees and structures.

- Verify their dedicated support.

After following these tips, you’ll have a clearer picture of what makes a reputable Gold IRA provider.

Factors to Consider When Investing in Gold

When investing in gold, several factors will significantly impact your success. First, evaluate the market trends to see how gold performs against other investments. Consider the purity of gold, as higher purity typically results in better value. Lastly, think about storage options, as proper security and insurance are vital to protect your assets.

- Review market trends.

- Assess gold purity.

- Choose storage options.

Thou should focus on knowledge and strategic planning to ensure your gold investments align with your financial goals.

Tips: When considering an investment in gold, you want to keep a few things in mind. Always assess the long-term value of your gold investments instead of short-term gains. Take into account the economic environment, as it can play a pivotal role in gold prices. Ensure you’re aware of storage fees and any associated costs that may eat into your profits. The thorough evaluation of these aspects will help you make informed decisions. Thou deserves a secure and prosperous future with your investments!

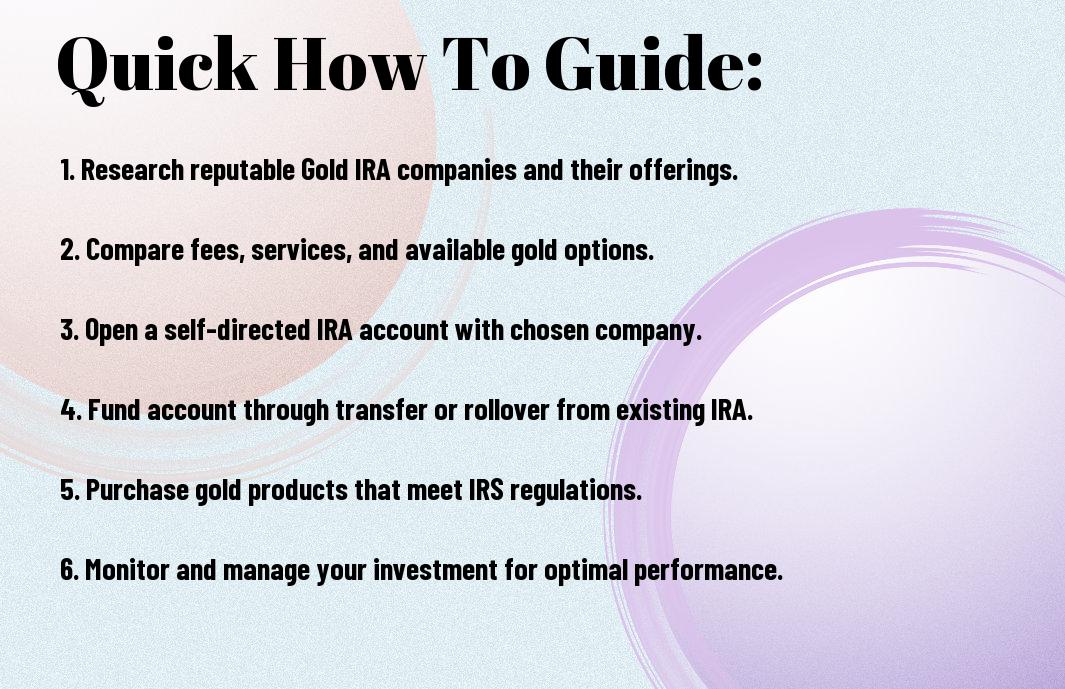

How to Start Your Gold IRA

The process of starting your Gold IRA can be streamlined and stress-free with the right guidance. Begin by selecting a reputable custodian who specializes in precious metals and understands the regulatory requirements. Next, you’ll need to open an account by completing the necessary paperwork, and then you can fund your account to start investing in gold.

Step-by-Step Guide to Setting Up Your Account

| Step | Description |

| 1 | Choose a reliable Gold IRA custodian. |

| 2 | Complete the account setup forms. |

| 3 | Transfer existing retirement funds to your new account. |

| 4 | Select your preferred gold assets. |

| 5 | Place your order and secure your gold. |

Tips on Funding Your Gold IRA

Now, considering the best ways to fund your Gold IRA can set you on the path to success. Here are some effective strategies:

- Consider a 401(k) rollover to avoid penalties.

- Assess if you can use cash deposits to enhance your investment.

- Look into direct transfers from other IRAs for convenience.

Knowing how to effectively fund your Gold IRA is a vital step for building your wealth.

Another approach to funding your Gold IRA is to explore additional options that may work best for your financial situation. Consider the following:

- Examine the possibility of contributing annually to your IRA.

- Utilize inheritance funds wisely to diversify.

- Factor in gifting strategies from family members.

Knowing the various options available can empower you to make sound financial decisions for your future.

How to Manage Your Gold IRA

Not only can you invest in gold effectively, but managing your Gold IRA is vital for maximizing returns. Regularly review your assets, stay updated with market trends, and consult with professionals when necessary. This proactive approach helps ensure that your investment aligns with your financial goals and security.

Tips for Monitoring Your Investment Performance

There’s no better time than now to focus on how your Gold IRA is performing. Keep a close eye on fluctuations in the gold market and assess your portfolio diligently. Here are some tips to consider:

- Track gold prices regularly to understand market conditions.

- Review transaction fees and management costs.

- Consult with financial advisors for professional insights.

Assume that staying informed will ultimately empower your investment decisions.

Factors That May Affect Your Gold IRA Value

Gold tends to fluctuate in value due to various factors influencing the market and economy. Your Gold IRA value is explicitly subject to trends in the global economy, interest rates, and investor sentiment. Consider these elements while assessing your investments:

- Global Demand: Changes in demand for gold from countries like China and India.

- Economic Factors: Inflation rates and currency strength can impact gold prices.

- Market Speculation: Investor behavior can drive the market trends.

Thou must analyze these influences closely to safeguard your assets.

Plus, there are more nuances to the factors affecting your Gold IRA value. It’s important to stay updated on global economic shifts and the dynamics of supply and demand. Other critical details include government policies impacting gold holdings and interest rates, which can drive or suppress gold prices. Discussing these elements with an advisor can ensure you are making informed decisions, as through continue your investment journey.

- Interest Rates: Higher rates can make gold less attractive.

- Geopolitical Stability: Unrest often drives investors to safe-haven assets like gold.

- Currency Strength: A weaker dollar typically boosts gold prices.

Thou should prioritize understanding these factors to navigate a successful investment strategy.

How to Withdraw from Your Gold IRA

For those looking to access their investment, withdrawing from your Gold IRA can be straightforward. You’ll need to contact your plan administrator and submit a withdrawal request form. Make sure to specify the amount and type of assets you wish to withdraw, as there might be different procedures for cash versus physical gold. Consider the tax implications and any associated fees before completing the transaction.

Tips for a Smooth Withdrawal Process

Withdrawals from your Gold IRA can be made hassle-free by following these tips:

- Consult with your financial advisor beforehand.

- Be aware of any transaction fees.

- Plan for the tax impact on your withdrawal.

Thou should stay proactive to ensure everything goes smoothly.

Factors to Keep in Mind When Withdrawing

Some important factors to consider when withdrawing from your Gold IRA include:

- The potential tax consequences of your withdrawal.

- Any penalties for early distribution.

- Your long-term investment goals.

Knowing these elements will help you make informed decisions about your financial strategy.

From evaluating market conditions to understanding tax brackets, the timing of your withdrawal can greatly influence the outcome. Ensuring that you are meeting all requirements can prevent any unexpected issues. Consider the implications of choosing a cash versus physical form as it impacts your portfolio balance. Examine exchange rates and assess current gold prices to maximize your benefits. Knowing how these details affect your withdrawal can lead to advantageous results.

How to Convert Other Retirement Accounts to Gold IRA

Many investors find converting their traditional 401(k) or IRA to a Gold IRA an attractive option for enhancing their retirement portfolio. This process involves rolling over your existing retirement funds into a self-directed IRA that permits you to invest in precious metals. With the right guidance and steps, you can effectively diversify your assets and secure your future wealth.

Tips for a Seamless Conversion

The process of converting to a Gold IRA can be made easier by following a few tips:

- Choose a reputable custodian to manage your account.

- Gather necessary documentation from your existing accounts.

- Understand the rules and procedures of the rollover.

- Consult a financial advisor for personalized advice.

Perceiving the importance of these factors can significantly smooth out the transition process.

Factors to Consider During the Transition

Gold investments can greatly enhance your retirement strategy, but there are specific elements to keep in mind during your transition to a Gold IRA.

- Evaluate the fees associated with setting up the new account.

- Understand the tax implications of the rollover.

- Be aware of investment options available within your Gold IRA.

- Consider the storage solutions for your precious metals.

Knowing these aspects can help you make informed decisions as you transition your retirement savings.

Factors such as fees, tax implications, and storage solutions play a significant role when transitioning to a Gold IRA. It’s important to compare different custodians to find the most affordable fees that align with your financial goals. Also, be aware of any tax consequences from your rollover, as this could impact your retirement planning. Additionally, ensuring a safe storage solution is vital for securing your precious metals. By focusing on these key considerations, you can proceed with confidence. Knowing how these facets interconnect can lead to better long-term wealth management.

How to Avoid Common Gold IRA Mistakes

Unlike many investors, you can sidestep the pitfalls of a Gold IRA by staying informed and making strategic choices. Don’t overlook the potential for error when selecting a custodian, buying the wrong types of precious metals, or failing to understand tax implications. Taking proactive steps will help secure your financial future.

Tips for Preventing Costly Errors

Clearly, avoiding mistakes in your Gold IRA is about being prepared and informed. Here are some helpful tips:

- Research and choose a reputable custodian.

- Diversify your investment within the gold market.

- Understand tax implications to make informed decisions.

Thou shall guard your investment by following these guidelines diligently.

Factors That Lead to Poor Investment Decisions

Little knowledge about the gold market can lead you to make poor investment choices. Key factors to consider include:

- Lack of research on market trends.

- Falling for scams or misinformation.

- Insufficient knowledge of diversification.

Perceiving these factors will empower your investment journey.

Understanding these elements is vital for you to identify potential threats to your Gold IRA. A lack of awareness about the dynamics of the precious metals market, falling victim to fraudulent schemes, and neglecting diversification can jeopardize your future wealth. By being proactive and informed about these factors, you cultivate a solid foundation for your investment. You are better equipped to protect your interests and seize opportunities in the gold market, leading you towards a rewarding experience. Perceiving this knowledge will guide your financial decisions effectively.

Final Words

Following this guide, you’re now equipped to explore the benefits of a Gold IRA and how it can help secure your financial future. Investing in gold can offer stability and wealth, giving you peace of mind for years to come. As you consider your options, take the time to find the best Gold IRA that aligns with your goals and aspirations. Your journey toward financial security and prosperity starts now—embrace it with confidence!

FTC Disclaimer and Disclosure

This article is intended for informational purposes only and should not be considered investment advice. The content is based on publicly available information and is not a solicitation to buy or sell any financial products. Any investment decisions should be made after consulting with a financial advisor.